There is “no intention” to change the mandate of the South African Reserve Bank (SARB).

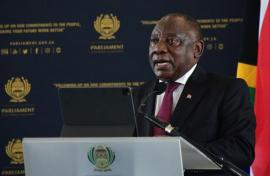

This is according to President Cyril Ramaphosa, who was speaking during a Questions for Oral Reply session in the National Assembly.

“South Africa faces a structural growth and unemployment problem, which cannot simply be addressed by a mere accommodative monetary policy stance. We need to focus on the structural factors constraining our economy.

“That is why as part of our efforts to accelerate growth and employment creation, we are committed to macro-economic stability, the rapid implementation of the reforms that we have undertaken and a capable state that provides the necessary public goods and services to its citizens.

“While the Reserve Bank should, without sacrificing price stability, take into account broader objectives such as employment creation and economic growth, there is therefore, no intention to review the mandate of the South African Reserve Bank,” he said.

President Ramaphosa emphasised that the independence of the bank is enshrined in the highest law in the land.

“The independence of the Reserve Bank is set out in our Constitution and the Reserve Bank has always acted independently without favour, without prejudice. It is one of those central banks that are highly respected in the world.

“We need to continue to uphold the independence of the central bank,” he said.

The President thrashed out the role of the bank and its accountability.

“In terms of our Constitution, the [SARB] in pursuit of its primary object, must perform its functions without fear, favour or prejudice but there must be regular consultation with the cabinet minister – in this case the Finance Minister – responsible for national financial matters.

“In terms of the [SARB] Act, the bank must and does publish a monthly statement of its assets and liabilities and an annual report and present those to Parliament. The bank is therefore accountable to Parliament. The governor of the bank holds regular discussions with the Minister of Finance and from time to time appears before the Parliamentary portfolio committee and select committees on finance. So the accountability of the bank is in place,” he said.

The President explained that the SARB’s monetary policy “creates certainty about future prices, which helps facilitate investment and consumption decision-making by firms and households”.

“Low and stable inflation also makes South Africa’s exports competitive relative to trade partners. By contrast, higher inflation harms economic growth and stifles employment creation.

“Higher inflation erodes the purchasing power and living standards of everyone, especially the poor. As inflation rises, the cost of living goes up. Most items cost more and people are not able to afford many of the items they usually buy,” President Ramaphosa said. – SAnews.gov.za